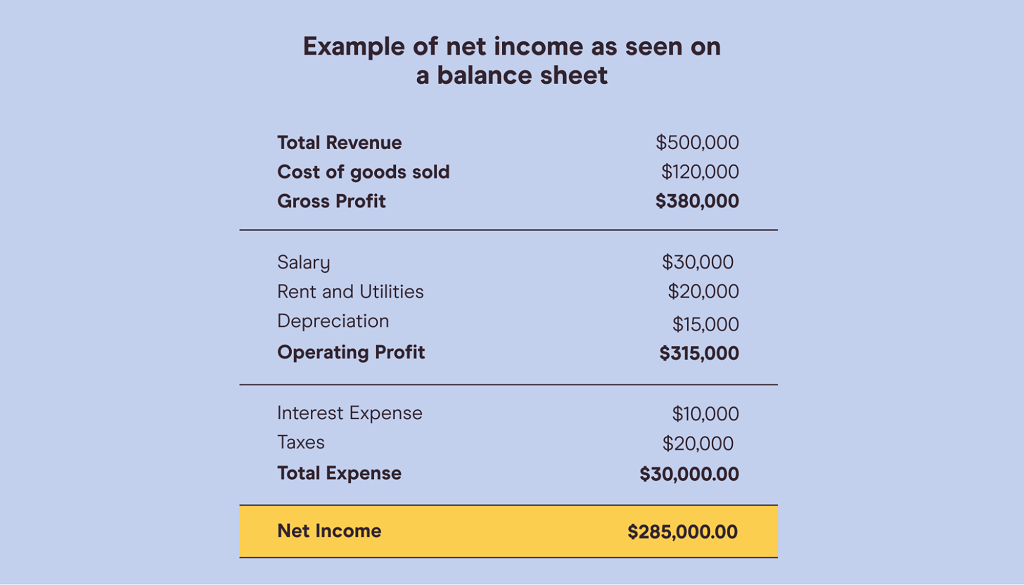

A company’s net Income, also known as its bottom line or net profit, is a crucial indicator of its financial health and performance balance sheets. Net Income represents the residual amount after deducting all expenses from total revenues. As a core profitability metric, net Income provides crucial insights into how efficiently a company operates.

While the income statement is the primary financial document showing a company’s revenues, expenses, and net Income, you can also determine net Income from the balance sheet using simple calculations. Here’s a step-by-step guide on how to find net Income from a company’s balance sheet.

Overview of the Balance Sheet

Before jumping into the net income calculations, let’s quickly review what a balance sheet shows. A balance sheet provides a snapshot of a company’s financial position at a specific time. It details what a company owns (assets), what it owes (liabilities), and the residual amount left for shareholders (shareholders’ equity).

The key accounting equation that underpins a balance sheet is:

Assets = Liabilities + Shareholders’ Equity

Assets are resources owned by the company, which can be further classified into current and long-term assets. Existing assets include cash, accounts receivables, inventory, and other assets that can be converted into cash within a year. Long-term assets, like fixed assets, intangibles, and long-term investments, provide future economic benefits beyond one year.

On the other side of the equation are liabilities and shareholders’ equity. Liabilities represent the company’s financial obligations that must be settled in the future. These can be current liabilities payable within a year or long-term liabilities payable over a longer duration.

Shareholders’ equity denotes the residual claims of shareholders against the company’s assets after settling liabilities. It comprises share capital, retained earnings, and other comprehensive Income.

Now that we’ve understood the fundamental balance sheet structure let’s determine net Income.

Steps to Calculate Net Income from a Balance Sheet

Here are the critical steps involved in finding net Income using information from a company’s balance sheet:

1. Identify Retained Earnings for Current and Previous Years

The first step is to locate the retained earnings line item on the balance sheet for the current year and the previous year. Retained earnings refer to a company’s cumulative net Income over its operating life minus dividends paid to shareholders. It gets carried over from one accounting period to the next.

For example, suppose a company’s current-year balance sheet shows retained earnings of $100,000 and the previous year’s balance sheet shows retained earnings of $60,000. In that case, the opening had an earnings balance of $60,000 at the beginning of the current year.

2. Subtract the Previous Year’s Retained Earnings from the Current Year’s Figure

Next, subtract the previous year’s opening balance from the current year’s retained earnings balance. The difference represents the net Income earned by the company during the current accounting period.

Using the example above, the calculation would be:

- Current year retained earnings: $100,000

- Previous year retained earnings: $60,000

- Net Income for Current Year = $100,000 – $60,000 = $40,000

This $40,000 is the company’s net profit for the current reporting period.

3. Adjust for Dividends Paid Out

The above calculation assumes the company did not pay any cash dividends during the year. If dividends were distributed to shareholders, we must factor that in to determine the accurate net income figure.

Dividends paid out are usually presented as a separate line item under the shareholders’ equity section of the balance sheet. To adjust, add back the dividends to the difference calculated earlier:

- Retained Earnings (Current Year) $100,000

- Retained Earnings (Previous Year) $60,000

- Dividends Paid Out $5,000

- Net Income = $100,000 – $60,000 + $5,000 = $45,000

So, the net Income for the year is $45,000 after adjusting for the $5,000 dividends paid to shareholders.

And that’s it! Following these simple steps, you can easily derive a company’s net Income earned for a particular period using the data from its comparative balance sheets.

Why Net Income Matters

Now that we know how to determine net Income from the balance sheet, let’s discuss why net Income is such a vital metric. Here are some reasons why net Income provides crucial insights into a company’s performance and profitability:

Shows Profitability

First and foremost, net Income shows a company’s capacity to generate profits from its operations after accounting for all costs and expenses. Positive and growing net Income indicates profitable operations. On the flip side, declining or negative net Income is a red flag of potential problems.

Helps Assess Management Performance

A company’s net profit over a period provides a straightforward yardstick to evaluate its operating and financial decisions. Improving net incomes often reflects management’s ability to control costs, increase efficiency, and boost revenues.

Determines Dividend Payments

Net Income earned also directly impacts a company’s ability to pay dividends to its shareholders. Dividends are produced from the residual net Income after retaining funds for reinvestment. Higher net Income means greater capacity to distribute dividends.

Influences Share Price Valuations

Investors’ valuation of a company’s share price depends heavily on its net income levels and growth. All else equal, higher net profitability drives greater investor interest and higher valuations for the company’s stock.

Provides Historical Performance Trend

Analyzing net Income over consecutive years provides insights into sales and profitability trends. Consistently rising net Income indicates improved business performance. Multi-year data also helps forecast future profitability.

Net Income provides pivotal inputs for financial analysis and business valuations. Now, look at examples demonstrating how to calculate net Income from actual balance sheets.

Examples of Net Income Calculation From Balance Sheets

Below, we will go through two examples using the published balance sheets of prominent companies to determine their net Income earned for 2019.

Example 1 – Apple Inc.

Let’s determine the net Income for Apple Inc. in 2019 using data from its comparative balance sheets:

- Retained Earnings as of Sept 2018 (previous year): $101,289 million

- Retained Earnings as of Sept 2019 (current year): $110,989 million

- Net Income for 2019 = $110,989 million – $101,289 million = $9,700 million

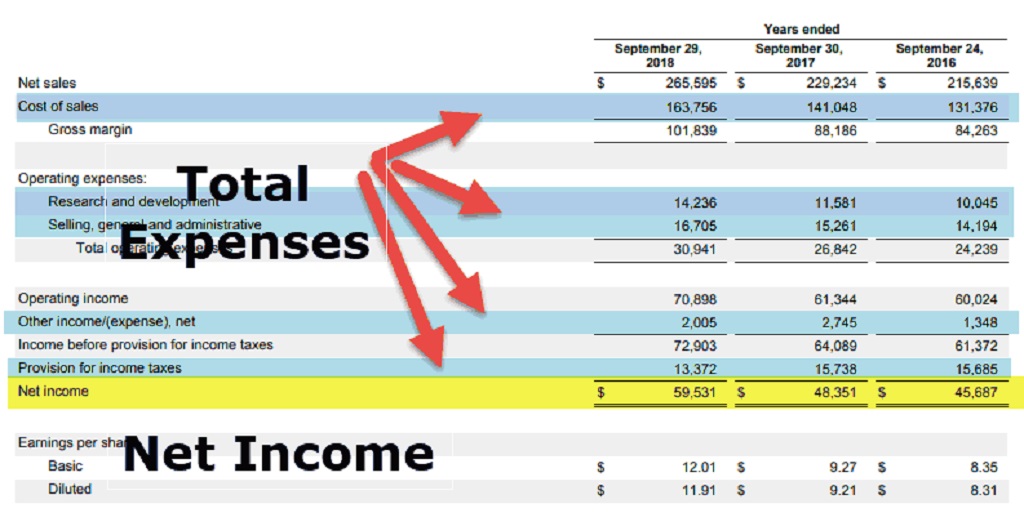

For 2019, Apple earned a net income of approximately $9.7 billion. Let’s verify this against Apple’s income statement for 2019:

- Revenues: $260,174 million

- Total Expenses: $229,234 million

- Net Income reported on Income Statement: $55,256 million

The net Income we calculated from the balance sheet is lower because Apple paid out dividends of $14 billion in 2019, decreasing retained earnings. After adjusting for dividends paid, the net income calculation matches the income statement:

- Retained Earnings as of Sept 2019: $110,989 million

- Retained Earnings as of Sept 2018: $101,289 million

- Dividends Paid in 2019: $14,000 million

- Adjusted Net Income = $110,989 – $101,289 + $14,000 = $55,700 million

So, our adjusted net income figure of ~$55.7 billion aligns with the reported amount.

Example 2 – Coca-Cola Company

Let’s go through a similar example by determining Coca-Cola’s net Income for 2019 using its balance sheet data:

- Retained Earnings as of Dec 2018 (previous year) = $18,464 million

- Retained Earnings as of Dec 2019 (current year) = $24,425 million

- Net Income for 2019 = $24,425 million – $18,464 million = $5,961 million

Again, let’s cross-check this figure against Coca-Cola’s income statement:

- Revenues for 2019: $37,266 million

- Total Expenses: $28,258 million

- Reported Net Income: $8,985 million

Coca-Cola also paid dividends of $6,775 million in 2019. Adjusting for this gives:

- Retained Earnings as of Dec 2019 = $24,425 million

- Retained Earnings as of Dec 2018 = $18,464 million

- Dividends Paid in 2019 = $6,775 million

- Adjusted Net Income = $24,425 – $18,464 + $6,775 = $8,736 million

The adjusted net Income is close to the reported $8,985 million figure on the income statement.

These examples demonstrate how we can accurately determine a company’s net Income from its comparative balance sheet data. By locating the retained earnings numbers for the current and previous years, calculating the difference, and adjusting for dividends, we can derive the net profit figure for that accounting period.

Net Income vs. Net Profit – Is There a Difference?

When discussing bottom-line profitability metrics, you may have encountered “net income” and “net profit.” So are they different, or simply two names for the same thing?

In most contexts, net Income and net profit refer to the same residual amount – the leftover Revenue after deducting total expenses for a period. Net Income is more commonly used in public company financial reporting and accounting literature, while net profit is the more colloquial term used in general business settings.

However, there are some nuanced differences:

- Accounting standards define and outline specific rules for calculating net Income, whereas GAAP standards do not bind net profit.

- Tax implications – Net Income is computed based on tax regulations, while net profit represents total revenues minus business costs.

- Line item – Net Income is always presented as a distinct line item on the income statement. Net profit may not be explicitly shown.

But barring these minor differences in usage, net Income and net profit indicate a company’s residual earnings after expenses. The terms are often used interchangeably without any change in meaning.

Net Income vs. Net Revenue – How They Differ

Net Revenue is another accounting term that can be easily confused with net Income. At first glance, they may appear similar, but net Revenue denotes something entirely different.

Net Revenue refers to the company’s gross revenues or sales after deducting returns, discounts, allowances, and other contra-revenues. It is calculated as:

Net Revenue = Gross Revenue – Contra Revenue Accounts

On the other hand, net Income is the leftover profit after subtracting all expenses from net revenues.

To summarize, the key differences:

- Net Revenue represents the net sales/revenues, while net Income represents the net earnings after all expenses.

- Net Revenue appears higher on the income statement. Net Income is calculated at the bottom line.

- Expenses are not deducted from net revenues. Expenses are deducted from gross revenues to derive net Income.

So, in essence, net revenues and net Income refer to completely distinct line items on a company’s financial statements.

Limitations of Calculating Net Income from Balance Sheet

While the balance sheet can provide the means to determine net Income indirectly, relying solely on this has limitations:

- Balance sheets offer snapshots at distinct points in time. They do not give details on revenues and expenses over a period.

- Non-operating Income, such as interest or dividends, is not captured in retained earnings, which can distort net Income derived from just balance sheet data.

- Changes in accounting policies between balance sheet dates can alter retained earnings balances and skew net income calculations.

- It doesn’t account for irregular items that may be adjusted for when computing net Income formally through the income statement balance sheets.

Therefore, while useful as a quick estimation tool, calculating net Income from balance sheet changes in retained earnings should not replace formally deriving it through the income statement using detailed revenue and expense accounts.

In Summary

Net Income or net profit represents a company’s residual earnings after deducting all operating costs and expenses from total revenues. It is a crucial measure of profitability and a business’s bottom-line results during an accounting period.

While the income statement provides the most accurate source for determining net Income, it can also be estimated from comparative balance sheet data. We can approximate the net Revenue generated over a period by analyzing changes in retained earnings after adjusting for dividends.

However, this methodology should be used with caution and care due to its limitations. The income statement must remain the primary source for deriving and evaluating net income figures.

By focusing on customers and continuously improving your business, you not only uncover hidden business prospects but also use monitoring net income trends over time as an essential barometer of business performance, providing crucial insights into your company’s financial health., growth prospects, and shareholder value. Robust and consistent net income growth is a strong positive signal for any business enterprise.